Welcome House Staff Officers from Atrium Wake Forest!

This is your Wake Forest endorsed home for Individual Disability Insurance without medical review. All portable plans include Specialty Own Occupation language. Click here to begin your instant quoting and application process from Guardian today!

Get an Instant Quote

Welcome to Mensh Insurance and your 2024-25 Individual Disability Insurance Home! As the locally endorsed agency by Human Resources at Wake Forest since 2010 we handle your Group Long Term Disability AND provide access to all major carriers for your individual policy options while in training and for beyond.

As you scroll through the site you’ll see a description of the hospital provided group plan that insures you as a resident or fellow as well as other educational materials and videos to explain the individual plan designs. Keep in mind that we are the only place you can evaluate plans in real-time with instant quotes and apply for and purchase your own policy without medical review. All quoted plans include features such as specialty own occupation, residual, and increase options. You can secure up to $15,000/month over time WITHOUT MEDICAL questions!

What separates Mensh Insurance from all others is that we bring ALL of the best products to you…what might be best for a female pediatrician might not be for a male general surgeon. We have all of you covered and can show you plans and pricing from Guardian, Ohio National, Mass Mutual, Principal, Ameritas, The Standard and even Lloyd’s of London! We represent them all and you get the maximum service and discounts available from all carriers via Mensh Insurance! The first step is to click on our quoting link from Guardian to begin evaluating your benefits and cost or email Danny directly by clicking HERE. There is no cost or obligation to get started and we will be back to you immediately with customized quotes to review either by email alone, by zoom, or in person. Contact us right away!

Read More

Critical Information Regarding Eligibility if You are Graduating

We understand and value your independence and freedom to work with any agency to secure valuable disability insurance. However, please note that should you apply with any insurance company and have medical conditions that could exclude you from protection, you could become immediately ineligible for our guaranteed issue program that Wake Forest has procured on your behalf. We strongly urge you to talk to us before applying anywhere else and risking ineligibility. We provide access to all carriers and all discounts are the same from all agencies. We will go above and beyond by protecting not only your income but your insurability under all circumstances.

Learn More from Guardian

As a resident or fellow your future income prospects are excellent but while you work towards your goals you do not have to sacrifice the quality of your disability insurance…the graded premium option allows you to purchase the best contractual wording at a much lower cost.

Disability Insurance for residents and fellows; why you have to buy it before you graduate!

Graded Disability Insurance Premiums-Lock in more for less!

Welcome to Mensh Insurance and your 2024-25 Individual Disability Insurance Home! As the locally endorsed agency by Human Resources at Wake Forest since 2010 we handle your Group Long Term Disability AND provide access to all major carriers for your individual policy options while in training and for beyond.

As you scroll through the site you’ll see a description of the hospital provided group plan that insures you as a resident or fellow as well as other educational materials and videos to explain the individual plan designs. Keep in mind that we are the only place you can evaluate plans in real-time with instant quotes and apply for and purchase your own policy without medical review. All quoted plans include features such as specialty own occupation, residual, and increase options. You can secure up to $15,000/month over time WITHOUT MEDICAL questions!

What separates Mensh Insurance from all others is that we bring ALL of the best products to you…what might be best for a female pediatrician might not be for a male general surgeon. We have all of you covered and can show you plans and pricing from Guardian, Ohio National, Mass Mutual, Principal, Ameritas, The Standard and even Lloyd’s of London! We represent them all and you get the maximum service and discounts available from all carriers via Mensh Insurance! The first step is to click on our quoting link from Guardian to begin evaluating your benefits and cost or email Danny directly by clicking HERE. There is no cost or obligation to get started and we will be back to you immediately with customized quotes to review either by email alone, by zoom, or in person. Contact us right away!

Read More

As a resident or fellow your future income prospects are excellent but while you work towards your goals you do not have to sacrifice the quality of your disability insurance…the graded premium option allows you to purchase the best contractual wording at a much lower cost.

Critical Information Regarding Eligibility if You are Graduating

We understand and value your independence and freedom to work with any agency to secure valuable disability insurance. However, please note that should you apply with any insurance company and have medical conditions that could exclude you from protection, you could become immediately ineligible for our guaranteed issue program that Wake Forest has procured on your behalf. We strongly urge you to talk to us before applying anywhere else and risking ineligibility. We provide access to all carriers and all discounts are the same from all agencies. We will go above and beyond by protecting not only your income but your insurability under all circumstances.

Learn More from Guardian

Disability Insurance for residents and fellows; why you have to buy it before you graduate!

Graded Disability Insurance Premiums-Lock in more for less!

Hospital Provided Group Disability Plan

All residents and fellows are insured by a group Long Term Disability Insurance plan via The Standard Insurance Company. Benefits cover 66 2/3% of salary to a maximum of $3,000/month, with benefits payable to age 65. It’s not until you reach an annual income of $54,000 that you would exceed the maximum of $3,000 in monthly benefit. For those earning in excess of $54,000, many will secure individual supplemental policies to insure the difference.

2025 Graduating Residents/Fellows

How Do I get Personalized Proposals and begin my No-Cost/No-Obligation Review with Mensh Insurance?"

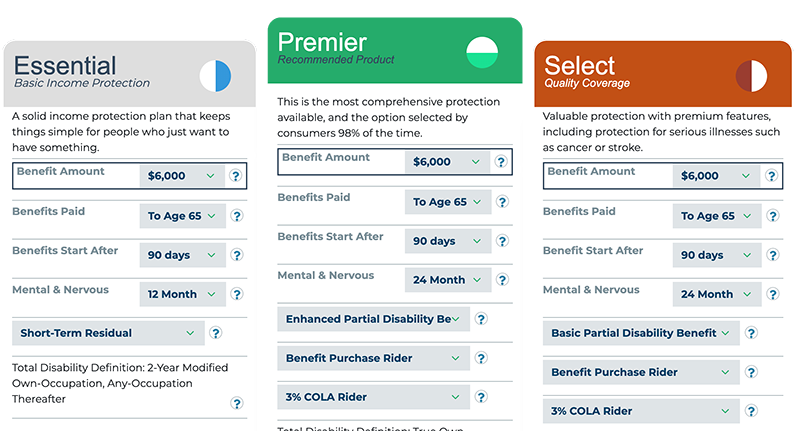

You now have a state of the art “Instant Quote Calculator” available as a Wake Forest Resident/Fellow. Simply click the link to begin your quote experience. From there you can customize your benefits and see your cost change in real time. You can even begin the application process online right away. OR, you can email danny@menshinsure.com or schedule a Calendly Zoom appointment for more help. You control the process!

For eligible graduating residents and fellows, the guaranteed issue1 plan from Guardian allows up to $7500/month for graduating residents and fellows and is available beginning January 1, 2025 for June 30(or later) 2025 graduates. All quote calculator plans reflect a Graded premium option designed for young physicians to lock in as much benefit as they can at a young age and lower cost with the ability to lock in a level fixed level cost at any time in the future once income stabilizes.

Discounts from Principal, Ohio National, Standard, Ameritas can also be compared and secured via medical review. Additionally, if you have a signed employment contract we can secure up to $15,000/month without medical review based on that information before graduation, OR as high as $20,000/month with medical review.

The Guardian Guaranteed Issue/No Medical review program allows a total of $15,000/month of protection. Any amounts beyond $15,000/month will require online medical review questionnaires.

This is one of the most critical pieces of all insurance discussion for residents and fellows: When an employer pays the premiums for any disability insurance on your behalf and you do not pay tax on the premium amount, all benefits would become taxable as ordinary income to you if you go on claim. So, for example, if you are a Wake Forest faculty physician and are eligible for the maximum of $20,000/month of group disability insurance benefit, you would end up with closer to $12,000/month NET after taxes. So, we SUPPLEMENT the tax loss by helping you secure an Individual policy for the $8000 you lost in tax. This would be tax free because you pay the premiums with after tax dollars.

The definition of Total disability can vary. The basic language says that if you cant perform your regular duties at the time of a disability, you are deemed disabled and eligible for benefit as long as you are not earning any other income. When we add an OWN OCCUPATION rider, the benefits are designed to pay EVEN IF you can do other things and earn other income as long as you cant perform your original duties.

“Specialty Own Occupation” adds another sentence to the contract to define your regular duties as your medical specialty which recognizes that you may have specific tasks inherent to that medical specialty that differ from other specialties. If you can’t perform exactly those tasks, you are deemed totally disabled. This is typically critical for all surgeons or anyone with invasive or interventional medical training.

All Guaranteed Issue program policies as well as ALL medically underwritten policies proposed by Mensh Insurance DO CONTAIN OWN OCCUPATION LANGUAGE.

3 BIG reasons…1. No GUARANTEED ISSUE offer once you finish at Wake Forest. So, if there are ANY health issues, you face declination and not getting coverage issued at all if you wait. 2. The insurance industry rules allow you to secure Individual protection and stack an unlimited amount of new Employer Provided Group coverage (typically without own occupation language etc) on top. However, if you wait and try to add individual policies on top of new group coverage, you will be limited to income and benefit maximums.

You sure do, it’s yours and totally portable with all discounts in effect to age 67.

The Guaranteed Issue plan includes a 15% multi life discount for all applicants on the first piece you secure as well as any additional amount after graduation.

All plans proposed by Mensh Insurance including the Guaranteed Issue plans include Residual/Partial, Cost of Living increase, Non cancelable and Guaranteed Renewable, Own Occupation Riders. All plans provide access to future increase options that won’t require medical review. All plans CAN add Catastrophic benefit riders to pay additional monthly amounts for long term care related benefits.

You can always fix and guarantee the cost and pay annually, semi-annually, quarterly, or monthly. A NEW FEATURE unique to The New Guaranteed Issue program offers a way to lock in the full $5000/month or $7500/month of benefit at your age today but with a way to pay far lower in your first few policy years. For many who go to Fellowship after residency, this is ideal, as your larger jump in income doesn’t take place for a few more years. At any time in the future, you can lock in the level fixed cost and we can show you in the original proposal design what those future costs will be.

Guardian’s Guaranteed Issue plans do offer an added rider for Student Loans. This is an extra elected rider to the base disability insurance policy that would provide an additional benefit to pay loan payments if disabled.

Of course! We offer Term Life Insurance to provide fixed cost and level benefit amounts for 10, 15, 20, 25, 30 years and can help you or a spouse with this process. We also provide Whole, Universal and Index Universal Life for those who seek permanent coverage and cash accumulation options. Click here for your Term Life Calculator and immediate rates!

2025 Non-Graduating Residents/Fellows

The hospital provides your Group Disability plan while in training and it is designed to replace 66 2/3% of your income up to a monthly maximum of $3000. Yo u Do Not Have to do anything at all to be insured by this plan.

Keep in mind that if you are on claim receiving benefits that amount will be taxed as ordinary income. We suggest that all residents consider securing an individual policy without medical review and this will pay $5000/month tax free. This will help replace what you lose in tax from the Group plan benefit and allow you to lock in the first $5000 of your individual protection at a much younger age using the far lower graded premium payment option. As a resident, you will pay this cost but can then fix it to a level cost once income stabilizes after training.

Guardian allows you to secure up to $5000/month of individual protection without full medical review at any time during your training! All of their plans include specialty own occupation and residual benefits. We also build in access to $5000/month of Guaranteed Future Increase Option benefits that allow you to avoid medical review for more benefit. Only income verification is required to complete the benefit increase.

Guardian’s Guaranteed Issue plans do offer an added rider for Student Loans. This is an extra elected rider to the base disability insurance policy that would provide an additional benefit to pay loan payments if disabled.

Of course! We offer Term Life Insurance to provide fixed cost and level benefit amounts for 10, 15, 20, 25, 30 years and can help you or a spouse with this process. We also provide Whole, Universal and Index Universal Life for those who seek permanent coverage and cash accumulation options. Click here for your Term Life Calculator and immediate rates!

Access to all major carriers